If you’re shopping for insurance, The Zebra sounds like exactly the site you need.

The platform claims to show you priced out quotes from “every major provider” in under five minutes. Rather than deal with the fuss and tedium of getting quotes on each individual provider’s website, get them all at once – without leaking your personal data.

Well, as someone who’s covered the insurance industry for years, let me tell you that The Zebra is both better and worse than it sounds. It far exceeded my expectations in some ways, and let me down in others.

The Zebra is an online insurance aggregator. Think of it like Kayak.com, but instead of finding the cheapest flight, it finds the most affordable insurance policy to meet your needs.

The Zebra isn’t the only aggregator on the block – in fact, there are several out there vying for pole position – but it’s one of the more popular ones thanks to its clean UI, customer service, and superb protection of your personal data.

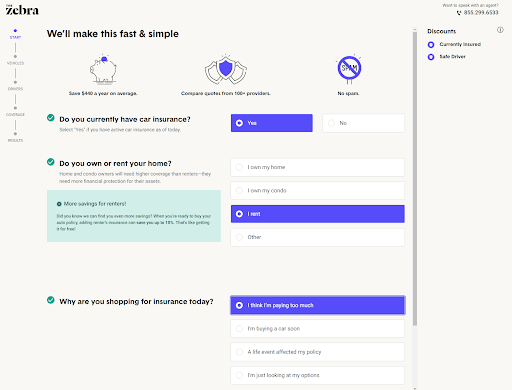

If you’ve ever tinkered with an online insurance aggregator before, The Zebra’s process will look 90% familiar.

It does, however, have a few surprises in store.

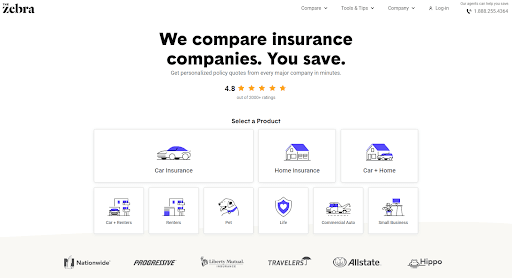

To start, the first thing you’ll see on The Zebra’s slick landing page is a nice, clean list of all the insurance types you can search for. As you can see, the list is expansive.

You’ll click on “Auto”, enter your zip code, and start filling in the rest of the blanks that The Zebra will need to gather quotes from various providers.

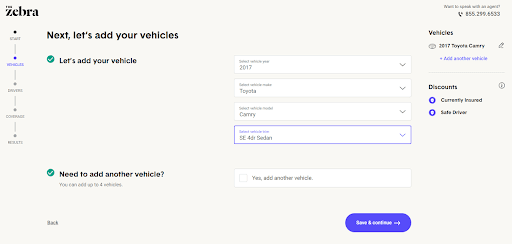

On the next two pages, you’ll enter your vehicle data:

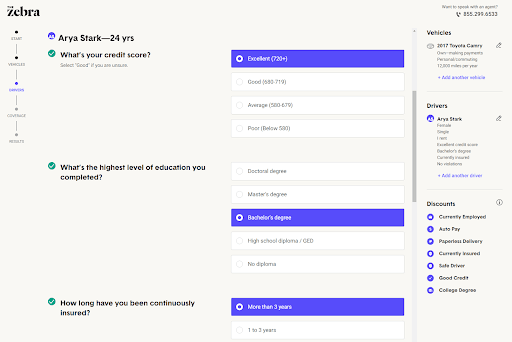

And now, The Zebra will ask all about you:

The Zebra certainly seems more thorough than other aggregators I’ve used. I can’t recall the last time an aggregator asked for my credit score – although I’m glad they did, because your credit score can impact your insurance premiums, and their asking serves as a nice reminder.

I also like how, unlike some other aggregators, The Zebra seems to put forth a direct effort to maximize your discounts with various providers. You can see a running list of the discounts you’ll likely qualify for with The Zebra’s various partners on the bottom right.

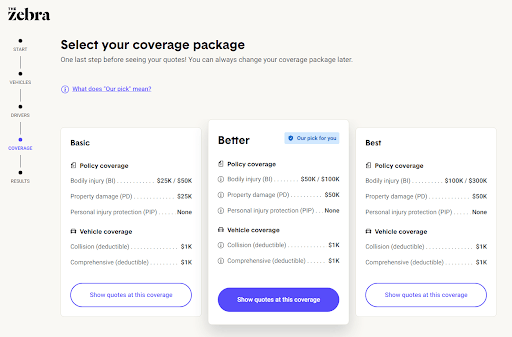

On the last page, The Zebra makes you play Goldilocks, suggesting the warm soup right in the middle.

Click “Show quotes at this coverage” and you’ll be swept away to that magical page displaying every major provider’s quote all at once. All that’s left is for you to cherry-pick the lowest rate, profit, and party.

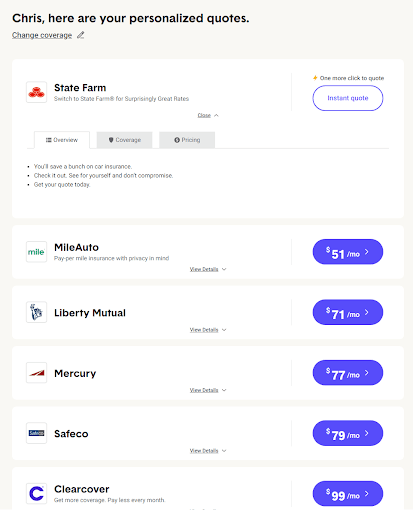

In reality, The Zebra only showed me nine quotes. Most were from providers I’d never heard of, and the rates weren’t all too impressive. Mind you, this was using my real information, not Arya Stark’s as pictured in the screenshots.

I was a bit surprised that State Farm’s quote wasn’t present, nor was it “instant” – the button simply rerouted me to State Farm’s online quote process. Granted, some of my information auto-populated, and that helps.

The Zebra costs nothing to use. It’s totally free – no paywalls, subscriptions, or membership plans. You couldn’t give The Zebra your money even if you wanted to.

How does The Zebra make money, then?

To their credit, The Zebra is actually pretty transparent about this. In fact, their revenue structure is laid bare on an FAQ on their homepage.

Basically, The Zebra operates using an old-school commission structure. If you find out through The Zebra that Liberty Mutual is offering the best rate, and click “Buy Online Now” to finalize your policy on Liberty Mutual’s site, the provider knows you came from The Zebra and will send them a kickback.

It’s worth noting that you can buy policies on The Zebra’s site, also. Same policy, same commission.

Now that we’re done with the walkthrough, let’s break down the individual tools and features of The Zebra and which is worth your time:

Insurance quote aggregator

The Zebra’s bread and butter is its insurance aggregator tool, which prompts you for some basic info in a crisp, clean workflow and uses it to collect insurance quotes from several major providers.

You can search for Auto, Home, Renters, Life, Pet, Commercial Auto, or Small Business Insurance (as well as bundles).

The final list of options you’ll get may not be totally comprehensive, but at least it saves you the time of having to re-input your information on each of these providers’ sites individually.

Even if a quote doesn’t populate in (usually because the insurance provider needs more information), you can simply click the link to hop over to the provider’s site, where most of your data will auto-populate.

Now, this is all helpful and certainly helps you cut some corners in your search for cheaper insurance.

Coverage estimator

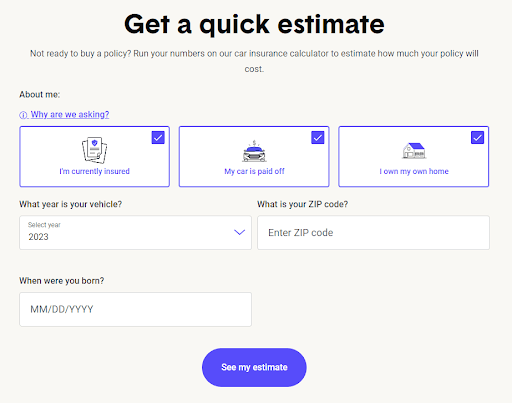

The Zebra has a tool I’ve never seen before on any competing insurance aggregator site: an insurance estimator.

Here’s how it works: based on your zip code, birthday, and just the model year of your car, The Zebra will ballpark how much you should be paying for car insurance each month.

Now, know that this is by no means a quote.

Insurance quotes are made up of hundreds, sometimes thousands of factors, so the little info The Zebra gets can’t really offer a comprehensive quote, but it’s a good place to get an estimate or two.

The Zebra’s learning center

The Zebra’s learning center is extremely fleshed out, and just plain easy to use.

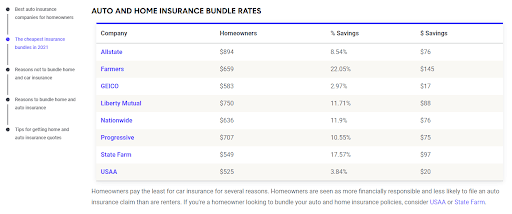

In fact, I’ve been reading The Zebra’s research for years. Like the Consumer Reports of insurance, The Zebra frequently sends out surveys to gauge customer satisfaction, rank providers against each other (even its own partners), and publish helpful statistics like the impact that bundling home and auto together can have on lowering your overall premiums:

A dedication to privacy (read: no spam)

The Zebra is truly dedicated to protecting our personal data.

With the amount of phishing and spam calls out there, entering your real information online has become the virtual equivalent of a trust fall. I remember thinking it would be innocuous to give my local hardware store my real cell number for a membership. Nope! Hammered by spam calls for weeks afterward.

You have to be extra careful with aggregator sites, since many of them make their money by immediately selling your personal data – not just waiting for a commission like The Zebra.

It’s disturbingly common for an aggregator to say the legalese equivalent of:

We’ll never spam you. Ever. Never ever…

… we’ll just sell your personal information to our 171 partners who will never stop calling you, which isn’t spam because you gave us permission without realizing it.

But so far, The Zebra seems like one of the good guys. I haven’t gotten a single spam email or phone call since giving them my real information. That’s admirable, since presumably, a fleshed-out customer profile for someone already seeking insurance is surely worth a pretty penny.

But The Zebra chose not to cash in and respect our privacy instead. Kudos.

Customer reputation

The final “feature” of The Zebra worth mentioning is their generally positive reputation among insurance shoppers.

The Zebra proudly publishes their ratings across several sites, including Clearsurance and Consumer reports, on their reviews page here. Users and critics alike seem to laud The Zebra’s usability, respect for privacy, and free access to live reps who can help out via phone.

But not everyone loves The Zebra.

The most common thread among dissatisfied users of The Zebra on business reviews site SiteJabber was expensive rates and a limiting amount of insurance companies included.

Even on Clearsurance.com, which The Zebra themselves link out to from their reviews page, isn’t full of universal praise. The company maintains a respectable 3.86 stars out of 5, with a total of 140 ratings, propped up by users who saved money:

All in all, a mixed bag, but mostly positive.

Would I recommend The Zebra to a friend? Depends what for.

As a resource for learning about the insurance industry, in a heartbeat. The Zebra’s staff does a fine job of collecting, organizing, and presenting insurance data to the benefit of everyone else in the industry, and they don’t charge a dime for it.

I’m sure it’s a massive and resource-intensive undertaking to aggregate all that data, so they deserve the highest of fives for it.

Now, would I recommend The Zebra to a friend who’s looking to buy insurance?

Yes, but with a few reservations.

See, the “problem” that The Zebra and other aggregators seek to solve is the tedium of entering the same information on multiple insurance websites.

But an aggregator only works if it shows everyone’s prices. Depending on who you are and the info you provide, you may not get as long of a list of quotes as you’d like.

Casual browsers

I would recommend heading to The Zebra to window shoppers who are casually browsing rates.

Maybe you’re considering a pet insurance “pawlicy”, and would just like to know what to budget. Or maybe you have a gut feeling that you’re overpaying for auto insurance (like my friend Jules), and would like a quick overview of what else might be out there.

When all’s said and done, The Zebra does show you multiple quotes at once, so it’s a good place to get a rough estimate of how much a particular policy might cost.

Those who already know which company they want

The Zebra is an aggregator, which means it’s a great jumping-off point to get quotes from a variety of companies. But, if you’re simply resigned to one or two companies due to brand loyalty, The Zebra won’t serve you.

Still, it wouldn’t hurt to use The Zebra to knock out one or two quotes. Heck, it may even find your best overall option.