Indexed Universal Life (IUL) insurance has become increasingly popular in recent years as a way to participate in stock market returns while still enjoying the protection and benefits of a life insurance policy. In this article, we will explore the top 10 IUL insurance companies that currently stand out in the industry. We will also discuss the benefits, drawbacks, and tax advantages of IUL policies. So, let’s dive in!

Top 10 Indexed Universal Life Insurance Companies

Which IUL insurance companies are currently leading the pack? Here is a list of the top 10 companies based on their policy performance, company strength, and structure of underlying fees:

- AIG

- John Hancock

- Lincoln National

- Mutual of Omaha

- National Life Group

- Nationwide

- North American Company

- Pacific Life

- Penn Mutual

- Prudential

- Securian

- Symetra

- Transamerica

Please note that these companies are listed in alphabetical order and the rankings may change as the industry evolves.

Our Current Top 3 IUL Companies

While all the companies listed above offer excellent IUL products, we have narrowed down our selection to the top three companies that we currently favor the most: Mutual of Omaha, Lincoln Financial Group, and John Hancock. These companies have demonstrated outstanding cash value accumulation concepts in the market.

-

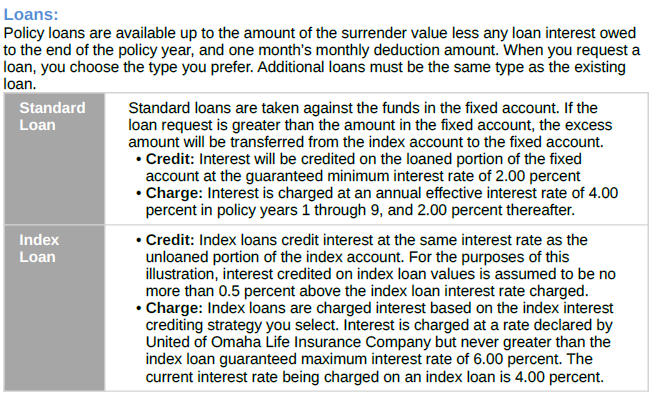

Mutual of Omaha: Mutual of Omaha has streamlined its IUL chassis to maximize cash value growth. The company also offers very low policy charges, ensuring that you don’t lose money during negative market returns. Additionally, Mutual of Omaha provides accelerated underwriting, allowing applicants to skip a medical exam. They also treat existing and new clients equally, providing the same cap and participation rates.

-

Lincoln Financial: Lincoln Financial’s IUL company, Lincoln National, offers two different IUL designs that provide index options beyond the S&P 500. This allows policyholders to potentially achieve larger, uncapped returns. Lincoln Financial also offers accelerated underwriting for qualifying applicants.

-

John Hancock: If you are looking for estate planning and wealth transfer options, John Hancock is a great choice. Their Second-to-Die Indexed Universal Life policy provides an excellent vehicle for passing on a legacy to the next generation in a tax-efficient manner. Their survivorship universal life policy pays out the death benefit upon the passing of both spouses.

About Indexed Universal Life Insurance

Indexed Universal Life Insurance, also known as IUL insurance, is a type of life insurance that offers a death benefit and a cash value account. Similar to traditional universal life insurance, the cash value in an IUL policy grows over time and can be accessed through partial withdrawals or policy loans. However, IUL policies offer the potential for greater growth due to the option of investing in subaccounts linked to the performance of an index, such as the S&P 500 or NASDAQ 100.

The ability to invest in equity-linked subaccounts within an IUL offers the opportunity for faster growth in periods of market success, subject to features like cap and participation rates. These rates determine the maximum growth and percentage of index performance that will be credited to the policyholder’s account.

It’s important to note that there are different types of life insurance policies available, each with its own characteristics and benefits:

-

Term Life Insurance: Provides death benefit protection for a specific term, usually 10, 20, or 30 years, with no cash value accumulation.

-

Whole Life Insurance: Offers guaranteed growth, a guaranteed death benefit, and a guaranteed minimum interest rate on cash value growth. Some whole life policies also provide dividends to further grow the death benefit and cash value.

-

Universal Life Insurance: Combines death benefit coverage with flexible premiums and some cash value growth.

-

Guaranteed Universal Life Insurance: Focuses primarily on the death benefit, with a guaranteed fixed rate of return.

-

Variable Universal Life Insurance: Allows policyholders to participate in market returns by investing in subaccounts similar to mutual funds.

Indexed Universal Life Insurance falls within the realm of universal life insurance but with the added potential for market-linked growth.

Floor, Participation, and Cap Rates

Indexed Universal Life policies offer attractive features such as floor, participation, and cap rates, which impact the growth potential and downside protection of the policy.

Floor Rate

A floor rate represents the minimum an index-linked subaccount can earn or lose in any given period. Typically set at no less than 0%, a floor rate ensures that even if the tracked index performs poorly, the policy account won’t suffer a loss (after accounting for fees or administrative expenses). Some policies even have positive floor rates that guarantee a minimum interest rate regardless of market performance.

Cap Rate

The cap rate determines the maximum percentage growth a subaccount can experience in a single crediting period. Usually ranging from 7% to 11%, the cap rate limits the return potential if the index performs exceptionally well. If the market rises above the cap rate, the subaccount will only be credited up to the cap rate for that period.

Participation Rate

The participation rate determines what percentage of index growth will be credited to the policyholder’s account, subject to the cap rate. For example, if the participation rate is 85% and the index returns 20% for the year, the account would be credited with 17% (85% of 20%). The cap rate further limits the credited interest to the maximum allowed.

It’s important to choose an IUL policy with favorable cap and participation rates. Some insurance companies may reduce these rates on existing policies while offering higher rates to attract new clients. Consider companies with a history of keeping rates equal between old and new policies to ensure fairness for policyholders.

Indexed Universal Life Insurance Mechanics

To understand how IUL policies work, let’s explore their mechanics:

-

IUL policyholders can allocate funds between a fixed account and one or more index-linked subaccounts within their cash value account.

-

Index periods determine the crediting rate for subaccounts. There are two common methods used:

-

Annual point-to-point: Calculates growth after considering the floor, cap, and participation rates for a year. This growth is then credited to the account, and the new cash value becomes the baseline for the next year’s crediting rate calculation.

-

Monthly average: Computes the average performance of the underlying index on a monthly basis. After applying the floor, cap, and participation rates, the interest is added to the account at the end of each month.

-

Insurance companies purchase options on the indices being tracked rather than directly investing in them. Cap and participation rates ensure that the policies don’t have to match the index’s return exactly but still generate sufficient returns to meet the policy’s guaranteed floor rate. The remaining funds not used for options are typically invested in bonds to generate income to cover the floor rate.

It’s important to note that index-linked subaccounts do not receive dividend interest associated with the tracked indices. Dividend interest can significantly contribute to an index’s total yearly return. However, IUL policies offer a tax-deferred growth advantage and downside protection to policyholders.

Evaluating IUL as an Investment

While life insurance is not typically considered an investment, IUL policies offer market-linked gains and tax-advantaged growth. Unlike retirement plans such as IRAs and 401(k)s, IUL policies have no annual contribution limits, making them attractive for adding to tax-advantaged retirement savings. Additionally, policy loans from IUL policies can be received tax-free, providing flexibility and potential retirement income.

IUL policies have gained popularity as an alternative to traditional investments due to their potential for stock market-like returns and downside protection. However, it’s crucial to analyze IUL carriers’ history of cap and participation rates adjustments in response to market conditions. Some IUL policies may not live up to their initially projected returns, especially if market conditions are mediocre or poor.

Advantages and Disadvantages of Indexed Universal Life Insurance

As with any insurance or investment product, IUL has both advantages and disadvantages. Let’s explore them:

Advantages:

- Market-linked growth potential in the cash value account

- Tax-deferred growth

- Access to cash tax-free via policy loans

- No annual contribution limits

- No required minimum distributions

- Penalty-free access to funds for healthcare and long-term care needs

- Protection from creditors and bankruptcy in most states

- Ongoing death benefit protection

- Income tax-free death benefit for beneficiaries

- Death benefit reduction options to lower costs

Disadvantages:

- Qualification for coverage based on health

- Potential for higher premiums as the insured ages

- Limited upside returns due to caps and/or participation rates

- Taxes on withdrawn gains

- Surrender charges on withdrawals during the earlier years of the policy

It’s important to recognize that the perceived advantages and disadvantages may vary depending on individual financial goals, risk tolerance, and objectives. Consulting with a professional can help determine if IUL is the right tool for specific financial needs.

Tax Benefits of Indexed Universal Life Insurance

Indexed Universal Life Insurance offers several tax advantages:

- Income tax-free death benefit proceeds for beneficiaries

- Income tax-free life insurance loans

- Tax-deferred growth of the cash value

Indexed Universal Life Insurance provides an avenue to accumulate and access funds on a tax-advantaged basis. Additionally, some IUL companies offer wash loans after a certain period, effectively eliminating the net cost of a policy loan and allowing for tax-free supplemental retirement income.

It’s crucial to note that market volatility and expenses can impact the performance of an IUL policy. Analyzing company history, cap rates, participation rates, and expenses is recommended before making a purchase decision.

IUL for Long-Term Care and Chronic Illness

Indexed Universal Life Insurance policies can also provide benefits for long-term care needs. Many individuals are turning to hybrid long-term care life insurance policies for added protection. These policies offer accelerated death benefits that can cover terminal illness and chronic illness expenses.

Some IUL companies offer riders for long-term care or chronic illness at an additional cost. These riders can provide benefits for qualifying chronic illnesses, allowing policyholders to access funds for healthcare needs and long-term care.

IUL Marketing

Indexed Universal Life Insurance has faced criticism regarding its marketing practices. It’s important to recognize that IUL is primarily a life insurance product, not an investment. Some insurers’ sales materials may create unrealistic expectations by only showcasing positive market performances without accounting for potential volatility.

Additionally, insurers may fail to disclose their ability to change cap and participation rates beyond the initial illustration period. Understanding projected performance during both good and poor market conditions is crucial. Seek out policies from companies with transparent marketing practices and consider the impact of policy fees on performance during market downturns.

Indexed Universal Life Insurance Rates.

To obtain accurate IUL insurance quotes, several factors need to be considered:

- Speak to an experienced life insurance agent who can understand your specific needs and goals.

- Determine if you require additional riders, such as term insurance, chronic illness, or waiver of premium riders.

- Choose the death benefit option that best suits your needs, such as return of premium, level, or increasing death benefits.

By working with an experienced agent, you can receive accurate quotes tailored to your specific requirements.

Managing and Monitoring IUL Policies

Once you have an IUL insurance policy in place, it’s essential to regularly review and evaluate it. Market conditions and changing financial needs may require adjustments to your policy. It’s best to consult with a professional specializing in indexed universal life insurance to ensure your policy aligns with your goals.

Regular policy reviews can help optimize your policy’s performance and ensure it remains an integral part of your financial plan.

Conclusion & Next Steps

Indexed Universal Life Insurance offers a compelling option for individuals who want to participate in stock market returns while also enjoying the benefits of life insurance. With the potential for market-linked gains, tax advantages, and flexibility, IUL policies can be an excellent addition to a well-rounded financial protection and wealth-building strategy.

To determine if an IUL policy is the best choice for your unique circumstances, we recommend scheduling a complimentary strategy session. Our experienced professionals will analyze your specific needs, goals, and objectives to help you make an informed decision.

Index Universal Life Insurance provides a flexible and tax-advantaged solution for individuals seeking protection, growth potential, and financial security. Explore your options today and secure your future!