Learn more about our methodology and editorial guidelines.

What Is the Cheapest Full Coverage Car Insurance?

The cheapest full coverage car insurance rate is $812 per year for a policy from American National. While this may be the cheapest policy overall, the best rate for you depends on a variety of factors.

Cheapest Full-Coverage Car Insurance

Below, we break down the cheapest full-coverage car insurance rates for several driving profiles. Unless otherwise specified, all estimates are for a single 35-year-old with a clean driving record and good credit, as this is a driver profile that excludes many rate-raising factors.

What Are the Cheapest Car Insurance Companies for Full Coverage?

American National, Country Financial, Nationwide, Erie and USAA offer the cheapest full coverage car insurance. Below are the 10 cheapest full-coverage car insurance companies:

Cheapest Full-Coverage Car Insurance Companies by State

Your location is one of the biggest factors that can influence your car insurance premium. This section shows the cheapest provider for full-coverage insurance in each state.

Best Cheap Full-Coverage Car Insurance

Cheapest Full-Coverage Car Insurance for Teens and Young Drivers

Cheapest Full-Coverage Car Insurance for Seniors

Below, we list the cheapest full-coverage car insurance providers for senior drivers:

Cheapest Full-Coverage Car Insurance for 65-Year-Olds

The cheapest full-coverage car insurance for 65-year-olds is from American National at an average annual cost of about $755.

Cheapest Full-Coverage Car Insurance for High-Risk Drivers

We categorized high-risk drivers as those with a DUI, an at-fault accident on record, a speeding ticket or poor credit. See which providers have the most affordable full coverage for drivers with different high-risk factors.

Read more: Best High-Risk Auto Insurance Companies

Cheap Full-Coverage Car Insurance After an Accident

American National tends to be the cheapest national provider if you’ve had an at-fault accident, as it offers average annual rates of $1,137.

Cheap Full-Coverage Car Insurance With a DUI

Our averages show American National is generally the most affordable provider if you want a full-coverage plan and have a DUI on your record, as it costs about $1,256 per year.

Cheap Full-coverage Insurance With a Speeding Ticket

After a speeding ticket, insurance rates tend to go up. The company with the cheapest full-coverage policy for drivers with a ticket on their record is American National at an average annual cost of $1,071.

Cheap Full-Coverage Auto Insurance for Bad Credit

At an average annual cost of $2,049, Country Financial is the cheapest provider for a full-coverage policy for drivers with poor credit.

How To Get Cheap Full-Coverage Car Insurance

According to our experts, there are five ways to get cheap full-coverage car insurance.

1. Contact a Local Agent

Contacting a local agent is one of the best ways to go about getting full-coverage car insurance. Local insurance agents are most likely to know about state and regional discounts that may apply to you or your family.

2. Purchase Coverage Through an Independent Broker

There are a number of advantages to purchasing full-coverage car insurance through an independent broker that finds the best insurance for you. While they may cost a fee upfront, independent brokers give drivers more options, provide unbiased advice and can help you save money based on your specific driving profile.

3. Get Quotes From an Online Portal

Getting quotes from an online portal for multiple providers and comparing them is an easy and safe way to save on full-coverage. If you’re shopping with a legitimate insurance company, there’s no reason to be wary of getting a quote online.

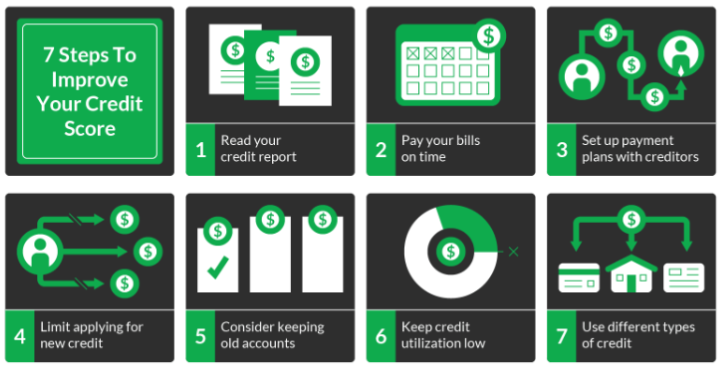

4. Work on Your Credit

Credit scores affect insurance rates in many states, so having good credit can help you get the best rates in the future. If your score takes a nosedive, you might see the cost of insurance begin to rise. See the tips below for getting your credit score back to good health.

5. Raise Your Deductible

Another way to save money is to increase your deductible, which applies to comprehensive and collision coverage. Raising your deductible will lower your monthly cost because you’re taking on more of the risk if you get into an accident. Be sure you can afford to cover your deductible, of course, because you’ll have to pay it out of pocket if you get into an accident and need repairs.

Cheap Full-Coverage Auto Insurance Quotes

Auto insurance rates, regardless of coverage level, take into account a number of different factors. To truly find the cheapest full-coverage for you and your specific situation, we recommend comparing quotes online between different providers.

While you may gravitate toward a provider whose name you recognize, a local provider may offer you better rates. Enter your zip code into our free quote tool below to see rates near you.

Average Cost of Full-Coverage Car Insurance

A full-coverage insurance policy is about $167 per month or $2,008 per year on average. These rates may change based on your driving profile.

How Much Is Full-Coverage Car Insurance?

The price you will ultimately pay for your premium depends on the state you live in, your driving habits and your age, among other factors. Below are the national average full-coverage rates for several of these factors:

Average Full-Coverage Car Insurance Rates by State

Below is the average cost for full coverage car insurance by state:

Read More

How Does Full-Coverage Car Insurance Work?

Full-coverage auto insurance is a combination of different car insurance coverages which, when combined, can provide financial protection. Generally, it includes the state-required minimum liability coverage plus collision and comprehensive insurance.

Full-coverage policies and the way they are structured can vary state-to-state based on whether the state you live in is a tort state or no-fault state. It should be noted that full-coverage is not required by law.

Read more: What Is Full-Coverage Car Insurance?

What Does Full-Coverage Car Insurance Cover?

When combined, liability, comprehensive and collision coverages cover both you and other drivers’ cars in accidents.

- Liability insurance: Liability car insurance covers medical bills and car damage for other people in accidents you cause. Almost every state requires minimum levels of liability coverage.

- Comprehensive coverage: Also called “other-than-collision” coverage, comprehensive insurance covers repairs if your car is damaged by anything other than a car-related accident. This includes things like damage from crashing into a wall, hailstorms, fire, falling objects, inclement weather, collision with a stationary object, vandalism and theft.

- Collision coverage: Collision insurance covers repair bills for your car, regardless of who caused an accident. This insurance covers up to the value of your car or pays a settlement value if your car is totaled. If you have a vintage or luxury car that appreciates in value, you can get classic car insurance that covers up to an agreed-upon value.

Cheapest Full-Coverage Insurance: The Bottom Line

Full-Coverage Car Insurance: FAQ

Below are some frequently asked questions about the cheapest full-coverage car insurance policies:

Best Full-Coverage Car Insurance: Our Ratings Methodology

Because consumers rely on us to provide objective and accurate information, we created a comprehensive rating system to formulate our rankings of the best car insurance companies. We collected data on dozens of auto insurance providers to grade the companies on a wide range of ranking factors. The end result was an overall rating for each provider, with the insurers that scored the most points topping the list.

Here are the factors our ratings take into account:

- Industry standing (20% of total score): Our research team considered market share, ratings from industry experts and years in business when giving this score.

- Availability (10% of total score): Auto insurance companies with greater state availability and few eligibility requirements scored highest in this category.

- Coverage (30% of total score): Companies that offer a variety of choices for insurance coverage are more likely to meet consumer needs.

- Cost and discounts (25% of total score): Auto insurance rate estimates generated by Quadrant Information Services and discount opportunities were both taken into consideration.

- Customer experience (15% of total score): This score is based on volume of complaints reported by the NAIC and customer satisfaction ratings reported by J.D. Power. We also considered the responsiveness, friendliness and helpfulness of each insurance company’s customer service team based on our own shopper analysis.

Our credentials:

- 800 hours researched

- 45 companies reviewed

- 8,500+ consumers surveyed

*Data accurate at time of publication.