When it comes to choosing an auto insurance company, it’s crucial to compare ratings and reviews to ensure you’re making an informed decision. By examining industry ratings and customer feedback, you can gauge a company’s financial strength, reliability, and customer satisfaction. In this article, we’ll take a close look at American National Auto Insurance to determine whether they’re the right choice for you.

American National Customer Reviews

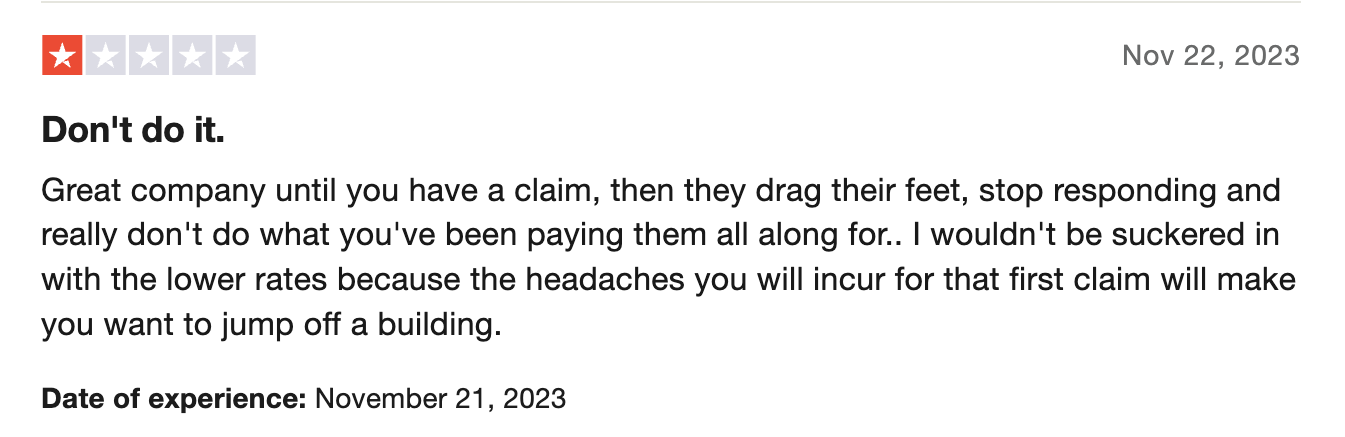

Before diving into the ratings, let’s explore what customers have to say about American National. Although there aren’t many reviews available, the majority of them tend to be negative. A common complaint revolves around poor communication. However, it’s important to note that individual experiences may vary.

American National Ratings

To assess an auto insurer’s credibility, it’s crucial to consider ratings from reputable agencies. Several organizations, including AM Best, S&P, Weiss, Fitch, and the National Association of Insurance Commissioners (NAIC), provide valuable insights into an insurance company’s financial strength and customer satisfaction.

Here are American National’s ratings:

- AM Best: A (Excellent)

- S&P: A (Stable)

- Weiss: B

- NAIC Complaint Index: 0.56 (Below average)

- Fitch: A (Stable)

American National Car Insurance Coverage Options

American National offers a range of coverage options tailored to meet your specific needs. In addition to the standard liability-only insurance required by states, they also provide collision, comprehensive, and full-coverage insurance. Furthermore, American National offers additional coverage options such as roadside assistance, gap insurance, and ACE insurance.

American National Car Insurance Cost by State

The cost of car insurance varies significantly depending on the state you reside in. Factors such as minimum coverage requirements and accident rates in your ZIP code can affect your average monthly premium. Take a look at the table below to get an idea of American National’s average monthly quotes in some states they operate in. Rest assured, American National provides competitive rates on average.

[Insert Average Monthly Quotes Table]

American National Auto Insurance Rates by Driving History

Your driving history plays a crucial role in determining your car insurance rates. Individuals with clean driving records typically pay less for auto policies compared to those with incidents on their records, such as speeding tickets, at-fault accidents, or DUIs. However, even if you’ve been involved in an incident, practicing safe driving habits can help alleviate the negative impact on your driving record and premium over time. Refer to the table below for American National’s average monthly rates for full-coverage and liability-only insurance based on different driving histories.

[Insert Rates by Driving History Table]

American National Car Insurance Cost by Age

Age has a significant influence on insurance premiums. Teen drivers often face higher rates due to their limited driving experience and higher accident risks. On the other hand, senior drivers may also experience higher rates due to the likelihood of sustaining severe injuries in accidents. Refer to the table below for American National’s average monthly car insurance rates based on different age groups.

[Insert Rates by Age Table]

American National Car Insurance Discounts

When choosing an insurer, it’s essential to consider available discounts that can help save money on your car insurance. American National offers various discounts that may be worth considering. Take advantage of these discounts to secure a more affordable policy.

FAQs

Q: How can I contact American National?

A: For contact information and customer support, please visit American National’s official website.

Q: Are online customer reviews reliable for assessing an insurance company’s quality?

A: While online customer reviews provide insights, it’s essential to consider individual experiences and evaluate a company using a combination of customer reviews and industry ratings.

Q: Does American National offer coverage options beyond the minimum required by states?

A: Yes, American National provides additional coverage options such as collision, comprehensive, and full-coverage insurance, as well as roadside assistance, gap insurance, and ACE insurance.

Conclusion

When considering American National Auto Insurance, it’s important to examine their customer reviews, ratings, coverage options, and rates. By conducting thorough research and comparing multiple companies, you can find the right insurer that meets your unique needs. Remember to consider factors like your driving history, location, and age, as these can significantly impact your car insurance premiums.