Best for Quick Quotes & Claims

Lemonade is a peer-to-peer property insurance brokerage service that manages homeowners and renters insurance policies. Founded in 2015, the company has quickly expanded from just one state to twenty-three states, the District of Columbia, and Germany by 2019. They launched themselves with the message “a tech company doing insurance, not an insurer doing an app.”

Through this insurtech start-up, customers can get a quote, purchase insurance, file claims, and monitor their policies either through Maya, Lemonade’s online AI system, or the mobile app, which also uses their artificial intelligence software. This allows Lemonade to offer some of the lowest premiums in the industry – starting at $5 monthly – because they’ve cut down on back-end costs.

Lemonade offers customizable coverage that caters to the needs of individual renters, an intuitive interactive online system, and a socially-minded business philosophy.

Screenshot lemonade.com July 15, 2019

Coverage Options & Customization

Like all standard insurers, Lemonade’s basic policy includes coverage for personal property, personal liability, loss of use, and medical payments to others. However, their starting coverage options are some of the lowest in the industry, with their personal property coverage starting at $10,000. This is one of the factors that enables them to boast premiums that start at $5; the higher the personal property coverage, the higher the premium becomes.

In addition, their basic coverage also includes damage caused by fire and smoke, crime and vandalism, bad weather (wind, lightning, and hail), and water damage, such as that caused by burst pipes and in-building flooding.

Note, however, that their coverage doesn’t include earthquakes damage except in California and Arkansas, bites from “high-risk” dog breeds, or flooding caused by an external source.

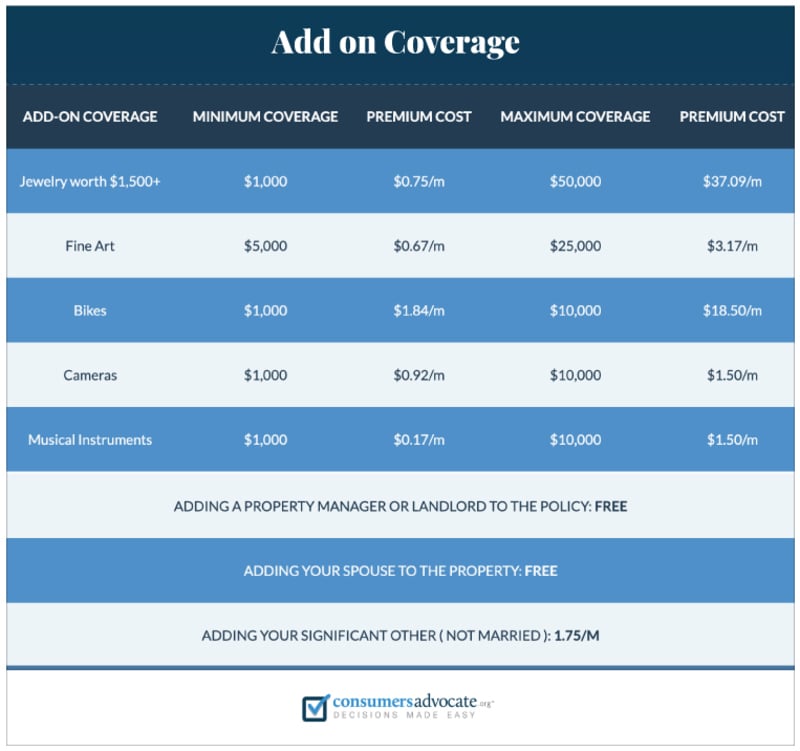

In addition, they don’t offer an option to add roommates to the renters insurance policy, which is a standard choice most companies offer. Nonetheless, renters can add their landlord and their spouse to their policy without added premiums, but significant others entail a $1.75 fee per month.

For a man or woman living in Greenwich Village, New York, example rates per month would be as detailed below. For this example, we used a $500 deductible as a standard for all, with no add-ons. Note that Lemonade’s deductibles can go as low as $250, but for comparative quotes across carriers, we went with $500, since this is the lowest most companies offer.

As seen, increases in personal property and loss of use affect premium costs the most. Nonetheless, even at $20,000 in personal property, $6,000 in loss of use, and $2,000 in medical payments the premiums quote only increases to $7.59 per month ($91.08/y). (Note, of course, that this is without adding extra coverages).

Add-ons & Policy Options

Lemonade offers a range of riders—blanket coverage for valuables above the category— for jewelry, fine art, bikes, cameras, and musical instruments. The limits for each of these vary, as do the coverages available.

Discounts

Lemonade’s only available discounts, according to their policy webpage, are for “smart” technology like fire and burglar alarms. They also offer a product called Zero Everything that can be activated once per policy and allows clients in select areas to file claims with no deductibles, without fear of having their rates increased, and at replacement cost value. This policy is only available in select areas.

Claims Process & Claims Satisfaction

With their integrated AI algorithms, Lemonade states that they can process a large amount of common claims (about 30% of them) in as little as 3 seconds. According to their webpage, their algorithms examine customers’ claims through the mobile app, check them for fraud, and then determine whether the claim can be paid instantly or whether the case needs to be delegated to their team.

Because Lemonade is such a young company with limited availability across the states, they have yet to appear on JD Power’s Claims Satisfaction Report, which is based on responses from 6,374 homeowners polled between April and November 2018. In their 2018 “Insurance Shopping Study”, JD Power stated that overall, insurtech customer awareness is still low, with only 6% of prospective customers indicating an awareness of Lemonade and other such companies.

Lemonade has a complaint index of 0.86 (the national median is 0.77) for 2018 according to the National Association of Insurance Commissioners, with a total of 5 complaints.

Online Content

Lemonade’s online content is geared towards raising consumer awareness about the ins and outs of the insurance industry. They use simple and direct language to explain the basics of insurance, coverage, deductibles, liability, premiums, and more. Their Insurance Dictionary is an excellent resource for consumers who want to learn more about insurance policies.

Screenshot lemonade.com, July 15, 2019

In addition, they are active in the community through social media and blog categories like “Insurance 101” and “Life-hacks,” which caters to young-professionals.

Social Mindedness

Lemonade’s Giveback program encourages users to pick a cause or charity when signing up to their services. At the end of the year, all unclaimed premiums (money not paid out in claims), minus expenses, are put towards the Giveback program and the causes chosen by the users.

In 2018, they were able to channel $162,135 to 15 nonprofit organizations, including Citymeals on Wheels, the American Red Cross, Teach for America, and a water project to bring drinking water to a community in Cambodia.

Screenshot lemonade.com July 15, 2019

Potential Downsides

Lemonade, like other insurtech companies, is a very young player in the insurance landscape. Although they have exponentially grown since they first began offering insurance in 2016, and have amassed popularity thanks to their apparently generous policy offerings, it is important to proceed with caution.

In addition, the way their online resources are organized can make it difficult to find clear and comprehensive information, which can lead to seemingly contradictory policies. For example, there’s currently very little information on what the limits are for electronic equipment and there are no apparent add-ons for them at the quote stage.

While they mention that jewelry coverage is capped at $1,500 (and if you have an engagement ring priced at the average $2,800 or more, you definitely need the add-ons), there’s no mention of electronic equipment. What if a $2,000 television screen is stolen? Is that covered by the personal property coverage or should you have gotten an additional endorsement for it? This information is not readily apparent at first glance from their website.

Policy 2.0

In 2016, Lemonade launched an interactive, collaborative, open-source policy creator with the stated goal of making insurance policies, and specifically policy-making, accessible to the general consumer. The policy creator will allow consumers to collectively participate in the co-creation of their renter insurance policies by employing “contemporary English that everyone understands.”

Policy 2.0 is currently only available in Germany, and it is unknown when it will be available in the United States. Concerns have been raised about the legality, practicality, and overall wisdom of this policy given, particularly, that consumers generally lack the legal expertise to draft legally-binding policy documents.

In addition, in the United States, the Department of Insurance regulates insurance policies. Each state’s DI is responsible for establishing their own particular limits on what an insurer can legally exclude or not in their policies. These are obstacles Lemonade will need to overcome in order to make Policy 2.0 available to U.S. customers.