Are you considering Globe Life insurance but unsure about their rates, coverage, and whether it’s worth it? Look no further! In this article, we’ll provide you with comprehensive information about Globe Life insurance, including rate charts, coverage details, and alternatives to consider.

Globe Life Insurance Rate Charts & Cost Calculator

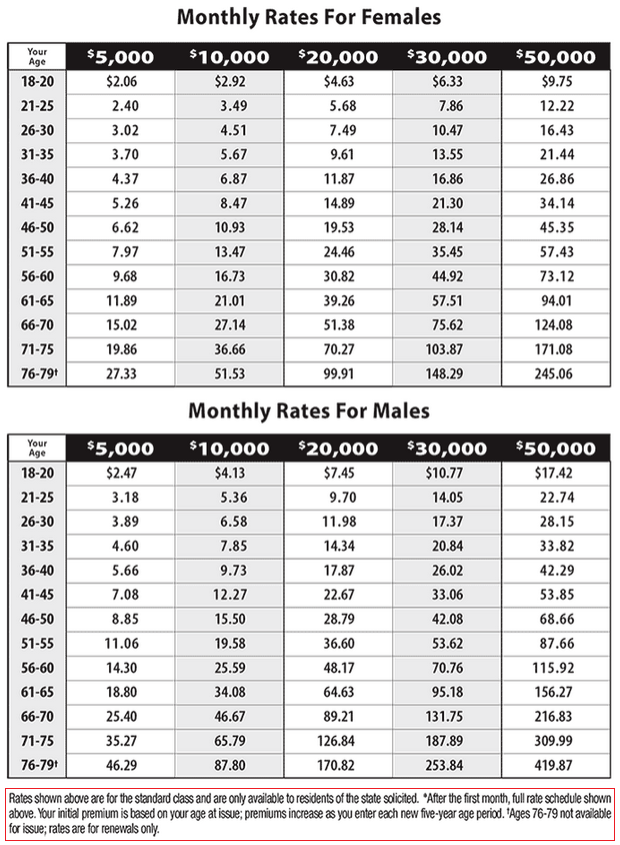

To start off, let’s take a look at Globe Life insurance rate charts and a handy cost calculator. These rate charts provide a breakdown of the monthly cost of Globe Life coverage for residents in different states. Please note that rates may vary depending on your state, so it’s essential to consider this when calculating your coverage cost.

The $1 Per Month Marketing Gimmick

You may have come across Globe Life’s $1 per month life insurance offer. However, it’s important to know that this is just a marketing gimmick. The $1 cost only applies to the first month of coverage. From the second month onwards, your actual price will come into effect.

How Does Globe Life Insurance Work?

Globe Life offers an increasing premium term life policy that typically expires on your 80th or 90th birthday, depending on your state of residence. It’s important to note that when the policy ends, you will no longer be insured and won’t receive any money back.

Globe Life determines its coverage rates using a five-year age group system, where everyone within each age bracket pays the same premium rate. For example, individuals aged 51-56 will have the same premium.

Additionally, as you enter each new age bracket, your rate will increase accordingly. This means that your premium will go up as you get older. For instance, a 66-year-old female residing in Nevada may initially pay $49.58 monthly for a $20,000 policy. However, on her 71st birthday, she will enter a new age bracket, resulting in an automatic premium increase to $67.81.

Globe Life insurance does not require a medical exam, but you will need to answer health questions to qualify. The approval process is relatively quick, with no waiting period once you’re approved. This means you’ll be fully covered from the day you make your first payment.

It’s important to note that Globe Life’s term policy does not accrue cash value like permanent life insurance.

Is Globe Life Insurance Worth Buying?

Globe Life may not be the best option for individuals seeking life insurance to cover funeral costs. There are two primary reasons for this:

-

Term Policy Limitations: Term life insurance is risky for funeral costs because most seniors outlive the policy duration. If your policy expires before you pass away, your family will have to bear the financial burden of your end-of-life expenses. To ensure indefinite coverage, it’s advisable to consider a permanent whole life final expense policy.

-

Qualification Challenges: Globe Life has strict qualification criteria and often declines seniors with common pre-existing conditions. Even if you’re considering a term policy for funeral expenses, your chances of approval with Globe Life may be slim if you have common health issues among seniors.

It’s worth mentioning that various other companies offer term policies with lower prices and fixed rates over time, unlike Globe Life’s increasing premium structure.

Best Alternatives for Final Expense Insurance

If you’re specifically looking for burial insurance or final expense coverage, Globe Life may not be your best choice. Here are five alternative no-exam final expense insurance companies that offer lifetime coverage with prices that will never increase:

- Mutual of Omaha

- Aetna

- Aflac

- AAA

- AIG

These companies provide comprehensive final expense insurance options, ensuring you have continuous coverage without the worry of increasing premiums.

FAQs

Q: Does Globe Life Insurance really cost $1 per month?

A: No, the $1 per month offer is only applicable for the first month of coverage. The actual price will be higher from the second month onwards.

Q: How does Globe Life insurance work?

A: Globe Life offers an increasing premium term life policy that typically expires on your 80th or 90th birthday. The duration of the policy depends on your state of residence. Your premium will increase as you enter each new age bracket.

Q: Is Globe Life insurance worth buying?

A: Globe Life may not be the best option for individuals seeking burial insurance due to term policy limitations and qualification challenges. There are alternative companies that offer better options for final expense coverage.

Conclusion

When considering life insurance options, it’s crucial to evaluate various factors such as rates, coverage, and qualification requirements. While Globe Life insurance may work for some individuals, it may not be suitable for everyone, particularly for those seeking coverage for funeral costs.

Explore alternative insurance companies that offer no-exam final expense coverage with fixed rates over time. Remember to consider your specific needs, eligibility criteria, and budget when making your decision.

Make an informed choice to ensure you have the right coverage that meets your needs and provides peace of mind for you and your loved ones.