Pros vs. Cons of Guaranteed Issue Life Insurance

As with any life insurance policy, there are pros and cons to this type of policy. And it’s important to understand them so you can find the right life insurance policy for you and your family.

The main benefit to a guaranteed issue policy is that you can get coverage regardless of your health or financial situation and you will not have to undergo a medical exam or answer any medical questions.

But on the other hand, guaranteed issue life insurance policies are the most expensive kind of life insurance policy. Your policy may include a 2- to 3-year waiting period for death caused by natural causes. And the death payout amounts are typically smaller than traditional whole life policies.

Pros Cons Your health and finances don’t impact your ability to get coverage More expensive – usually 2-3 times the cost of traditional life insurance Short approval process 2- to 3-year waiting period No medical exam or health questions Small death payouts

No Medical Exam, No Health Questions

When applying for traditional life insurance policies, you are required to undergo a medical exam or answer a few questions about your health. But with a guaranteed issue life insurance policy, you will never have to sit for a medical exam or answer any questions about your health.

Costs

Guaranteed issue life insurance policies are more expensive than other policies because the insurer is taking a risk by issuing a policy without understanding the insured’s health condition. In fact, the premiums can run substantially higher and because of the waiting period, you aren’t truly covered until the third or fourth year. In most cases, the cost is 2-3 times the cost of traditional life insurance.

Is Guaranteed Issue Life Insurance Worth It?

Guaranteed issue life insurance is worth it if you have no other options. Some people can’t qualify for traditional life insurance policies because of their health, and in these circumstances they may be willing to pay much higher premiums to leave their loved ones a payout after they’re gone. Keep in mind that most guaranteed insurance plans have a modified payout period. The full death benefit isn’t typically paid unless the policyholder lives past the graded period. If you have a terminal disease, it’s important to realize that if you pass before the graded period is over your loved ones only receive a refund of premiums paid, plus 10 to 20 percent.

If you can pass a medical exam, this type of policy is probably not right for you. That’s because the premiums are higher, and you will have a waiting period that doesn’t come with traditional policies. If you don’t want to pass a medical exam, but are willing to answers a few health questions, final expense life insurance may be the right policy for you.

Who Is Guaranteed Issue Life Insurance Typically For?

People who have serious medical conditions like cancer are good candidates for guaranteed issue life insurance policies. That’s because it can be very difficult to qualify for other policies with serious medical conditions such as this.

But that doesn’t mean guaranteed life insurance is your only option. For instance, you can buy burial insurance whole life policies without having to sit for a medical exam. Burial insurance can typically be issued by answering health questions on the application.

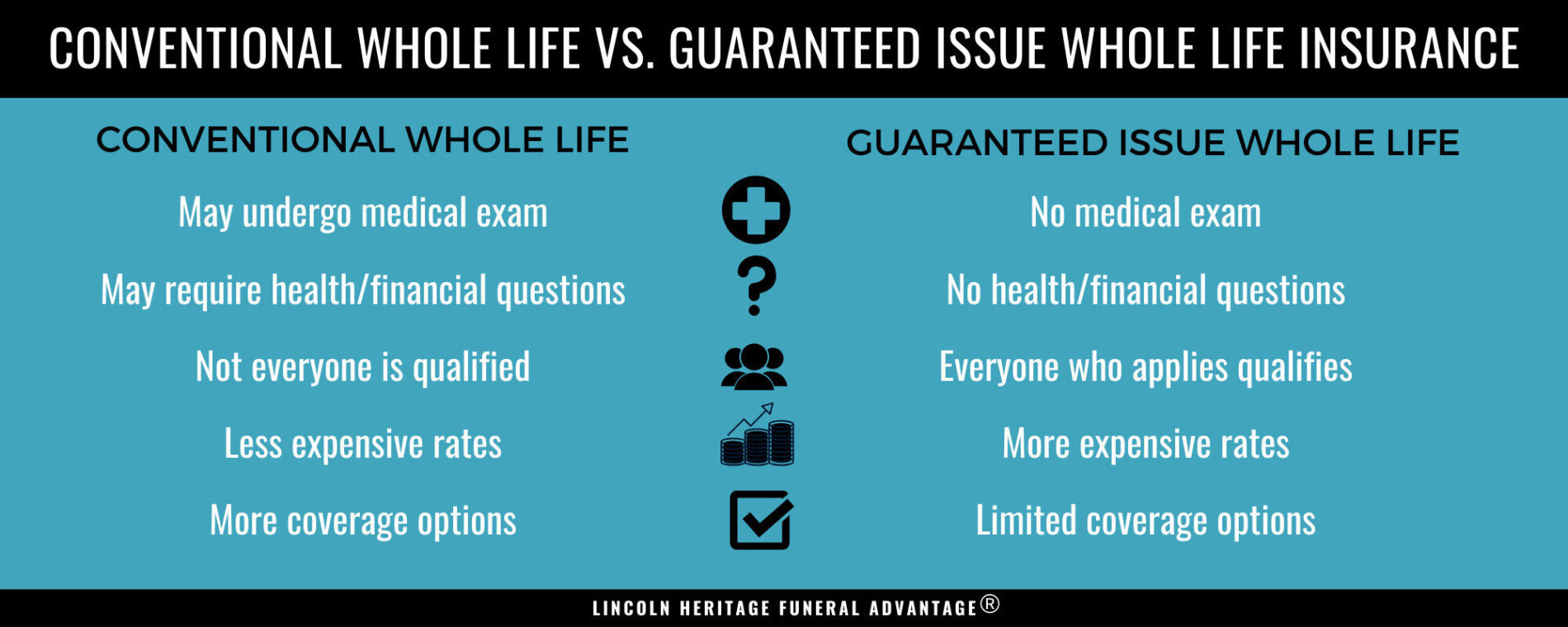

Difference Between Conventional Whole Life and Guaranteed Issue Whole Life Insurance

Traditional whole life insurance policies and guaranteed issue whole life insurance policies are quite different in how they approve applicants for a policy.

When applying for a conventional life insurance policy, you will have to sit for a medical exam or answer some questions related to your health. You will also have to undergo financial scrutiny. The insurer uses underwriters to examine your health and financial history to determine whether or not you are a good risk. If you are, the insurer will issue you a policy. But if you’re not, your application could be denied. If approved, the insurance company determines your premiums based on your age, sex, and health.

On the other hand, when you apply for a guaranteed issue whole life insurance policy, the insurer does not use underwriters. Instead, everyone who applies is automatically accepted. And your premiums won’t be based on your health. Instead, the insurer has premium guidelines that apply to everyone – regardless of health or finances.

Comparing Guaranteed Issue Whole Life vs. Guaranteed Issue Term Life

When choosing your insurance policy, you can choose between a whole life policy and a term policy. You can find both whole life and term insurance policies that are guaranteed and don’t require medical exams or answers to medical questions. But there are some major differences between the two.

Guaranteed Whole Life Insurance

Guaranteed issue whole life insurance policies are long-term policies that stay in effect as long as you pay the premium. You will not have to qualify for this type of policy by taking a medical exam or answering questions about your health. When you pass, the insurer will pay your loved ones a tax-free payout that they can use to pay for your final expenses or anything else they want to buy with the money. Whole life policies also accumulate cash value and can pay dividends.

Because there is no medical exam or health questions, you should expect to pay higher premiums for this type of whole life policy.

Guaranteed Term Life Insurance

A guaranteed issue term life insurance policy is only good for the term you agree to when you purchase the policy. For example, you can purchase a 10-, 20-, or 30-year term life policy. As long as you pay the premium for that time period, your life insurance policy is in effect.

But once the term ends, you no longer have insurance. Say you buy a 10-year term life insurance policy and pay the premiums for ten years. You will no longer have a valid insurance policy on the day after the 10-year term. And when you renew the policy, you will be 10 years older, which means your premiums will go up to reflect that.

You can also purchase a guaranteed issue term life insurance policy with no medical exam and without having to answer questions about your health. You can ask about buying a renewable term policy, which means you can renew you can continue to renew your policy without having to take a medical exam.

Some people think about term life insurance for aging parents, but that may not be the best option if the parent outlives the term life insurance policy. When buying life insurance for parents, consider all of your options.

Pros and Cons

As with other insurance policies, you need to evaluate the pros and cons to determine if guaranteed issue whole life insurance or guaranteed issue term life insurance makes sense for you.

Guaranteed Whole Pros Cons A long-term policy that stays in effect as long as you pay the premiums The policy is more expensive than conventional whole life policies The policy has cash value 2-3 year waiting period No medical exam or questions about your health Higher premiums Automatic acceptance Guaranteed Term Pros Cons Guaranteed acceptance regardless of your health The policy has an expiration date Lower premiums than whole life It may be more expensive when you renew your policy 2-3 year waiting period before the face value is paid