Import car insurance is not your typical auto insurance policy. When you have an imported vehicle, it’s important to understand the unique coverage needs that come with it. In this article, we will explore what import car insurance covers and why it’s essential for owners of imported vehicles.

What is Import Car Insurance?

Import car insurance is specifically designed for vehicles that have been imported from outside the country. If your vehicle was registered in another country before being brought to your current location, it is considered an import. Since these vehicles are not domestically produced, they may have different features and requirements that need to be taken into account when selecting an insurance policy.

Import vs. Domestic

It’s important to note the distinction between import and domestic vehicles. In today’s global economy, many vehicles, even from well-known American brands, are manufactured overseas. However, just because a vehicle is manufactured overseas does not automatically make it an import car.

An import car is any vehicle that has been legally imported from another country outside of the manufacturer’s official distribution system. These vehicles are typically imported by dealers specializing in smaller, niche markets or by individuals who import single vehicles. Import cars often have unique requirements when it comes to insurance coverage due to their limited availability and specific features.

How to Determine if Your Car is an Import

If you are unsure whether your car is considered an import, you can check its records. The car’s records will indicate if it was previously registered in another country, confirming its import status. To find this information, you will need the vehicle identification number (VIN) to look up its report.

What Does Import Car Insurance Cover?

Import car insurance includes standard insurance products for all types of vehicles, but it may also offer special coverages tailored to the unique needs of imported cars. Here are some of the coverages typically included in import car insurance policies:

Rising Value Protection

Import cars are known for their potential to appreciate in value over time. Rising value protection is a special coverage that takes this into account. It allows you to protect the increase in value of your car beyond the initial agreed value stated in your insurance policy. This means that if your car appreciates in value but is damaged before the rising value is reflected in your policy, you will be compensated for the increased value.

For example, let’s say you purchased an import car and insured it for an agreed value of $20,000. Two years later, the car is involved in a total loss accident, and its value has increased to $30,000. With rising value protection at 50%, your insurance company will compensate you for the full $30,000 value to account for the appreciation.

Spare Parts Coverage

Spare parts coverage helps pay for replacement parts in the event of an accident. Since import cars often have unique parts that can be more expensive and harder to find, this coverage is particularly useful. Some insurers may also offer coverage for original equipment manufacturer (OEM) parts, which are original parts from the vehicle manufacturer.

Top Import Car Insurance Companies

When it comes to insuring your import car, it’s important to choose a reputable insurance company that understands the unique needs of imported vehicles. Here are some top insurance companies that offer import car insurance:

Progressive

Progressive offers import car insurance through its Progressive Classic Car by HagertyⓇ program. While it’s primarily geared towards classic cars, it can also apply to imported vehicles that meet certain criteria. Progressive offers unlimited mileage on import car insurance, but the vehicle must be used primarily for pleasure and not as a daily driver.

Geico

Geico collaborates with American Modern, a classic and exotic car insurance specialist, to insure imported cars. To qualify for import car insurance from Geico, the vehicle must be at least 25 years old, stored in an enclosed and locked structure, and driven only occasionally for pleasure or to shows, rallies, and events.

USAA

USAA offers import car insurance in partnership with American Collectors. It provides specialty insurance for a wide range of vehicles with collectible value, including muscle cars, high-performance sports cars, and classic motorcycles. To qualify for import car insurance from USAA, the vehicle must be driven only for pleasure on a limited basis and stored in an enclosed and locked structure.

Other Types of Car Insurance

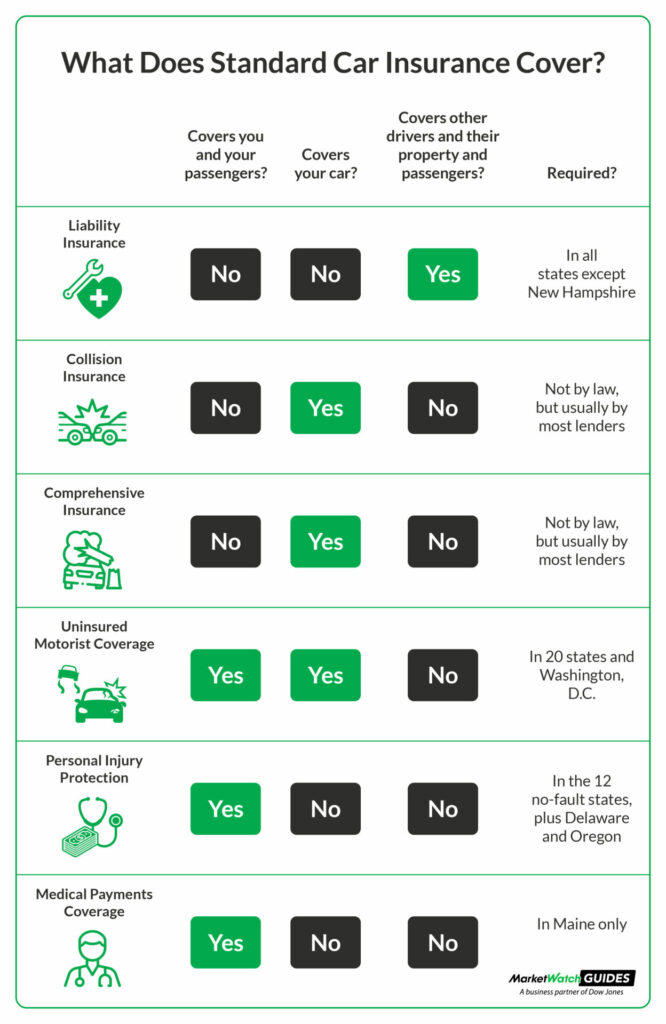

While import car insurance may come with special coverages, it also includes standard car insurance coverages that you would find in any other policy. Here are some of these standard coverages:

Property Damage Liability Insurance

This coverage pays for damages you cause to someone else’s property, such as their home, fence, or car.

Bodily Injury Liability Insurance

Bodily injury liability insurance covers medical expenses for injuries to others when you’re at fault in an accident.

Collision Coverage

Collision coverage pays for damages to your vehicle resulting from a standard car accident or collision with another object.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by incidents other than collisions, such as theft, vandalism, or natural disasters.

Personal Injury Protection (PIP)

PIP insurance covers medical expenses and related costs for you and your passengers, regardless of fault.

Medical Payments Coverage (MedPay)

MedPay covers medical bills for you and your passengers, regardless of fault. It is required in Maine.

Uninsured/Underinsured Motorist Coverage (UM/UIM)

UM/UIM coverage protects you when you’re in an accident with a driver who has insufficient or no insurance.

Conclusion

Import car insurance is essential for anyone with an imported vehicle. It offers specialized coverages that protect the unique features and value of these vehicles. When selecting insurance for your import car, take the time to compare rates and coverages from reputable insurance companies that understand the specific needs of imported cars.

FAQs

Q: What is import car insurance?

A: Import car insurance is designed specifically for vehicles that have been imported from outside the country. It provides coverage tailored to the unique needs of imported cars.

Q: What does import car insurance cover?

A: Import car insurance typically includes standard insurance coverages for all vehicles, along with special coverages such as rising value protection and spare parts coverage.

Q: How do I know if my car is an import?

A: You can check your car’s records to see if it was previously registered in another country. The vehicle identification number (VIN) will help you find this information.

Q: Can I get import car insurance from any insurance company?

A: While many insurance companies offer import car insurance, it’s important to choose a company that understands the unique needs of imported vehicles and can provide the necessary coverage.

Q: What are some top import car insurance companies?

A: Some top import car insurance companies include Progressive, Geico, and USAA. These companies offer specialized coverages for imported vehicles.

Data accurate at the time of publication.