Learn more about our methodology and editorial guidelines.

What Is Car Insurance for Teenagers?

While you may have heard the terms “teenage drivers insurance” or “teen car insurance,” there’s technically no type of car insurance policy exclusive to teenagers. Whether a driver is a 16-year-old or a 96-year-old, they’ll need to meet a state’s minimum requirements for liability insurance. If the car is being financed, a lienholder will likely require collision insurance and comprehensive coverage as well.

What’s the Best Insurance Coverage Level for Teenage and Young Adult Drivers?

Determining the most appropriate level of coverage for teenage drivers requires a knowledge of the basic coverage levels for auto insurance. The sections below contain basic information about each of the main coverage types:

Liability Insurance for Young Drivers

If you’re buying coverage for a teen driver or buying your own policy as a new driver, it’s helpful to know the different types of insurance. Almost every state requires some form of liability car insurance, which covers damages for others when a driver is at fault. Here are the main parts of liability coverage:

- Bodily injury (BI) liability: This covers lost wages, medical bills and other expenses for someone who’s injured when you’re at fault for an accident.

- Property damage (PD) liability: This covers damage to someone else’s property — such as a vehicle — when you’re at fault for an accident.

The minimum level of liability coverage varies from state to state. For example, motorists in North Carolina are expected to carry 30/60/25 coverage, which means a policy would pay up to $30,000 per person for bodily injury, $60,000 per accident for bodily injury and $25,000 per accident for property damages.

Collision Auto Insurance for Teenagers and New Drivers

Collision insurance protects your vehicle in the event of a collision, no matter who’s at fault. Though collision coverage isn’t required by state law, a lender will likely require it if you’re financing a vehicle to protect the investment.

Collision coverage will reimburse you for damage to your car and give you a payout up to the actual cash value (ACV) of the vehicle if it’s deemed a total loss. However, collision insurance doesn’t cover damage in non-moving situations.

Here are some situations that would involve filing a collision insurance claim:

- Hitting a guardrail

- Colliding with another vehicle

- Getting damage from a road hazard like a pothole

Comprehensive Car Insurance for Teen and Young Adult Drivers

Comprehensive insurance is another common requirement for drivers financing a vehicle. Unlike collision insurance, it’s geared more toward non-driving scenarios.

Comprehensive coverage will reimburse you for damages in the event of:

- Collision with an animal

- Damage from the environment (flood, hail, fire or tree sap)

- Damage from falling objects

- Theft or vandalism

Other Car Insurance Coverage Levels to Consider For Young Drivers

Other types of insurance policies include:

- Gap insurance: This will pay the remainder of an auto loan if a vehicle’s ACV payout is insufficient.

- Medical payments (MedPay): This covers medical bills from the driver or other passengers.

- Uninsured/underinsured motorist (UM/UIM) coverage: This provides additional financial protection if you’re in a wreck where the driver who’s at fault is uninsured or doesn’t have enough insurance to cover damages.

How Much Is Car Insurance for Teens and Young Drivers?

According to our full coverage rate estimates, teenage car insurance averages $5,298 per year or $467 per month. Rates are higher for teenage drivers compared to other age groups for several reasons, which we’ll explore further below.

Insurance Rates By Age Group

Here’s how car insurance for young drivers stacks up against other age groups:

Car Insurance for Teens and Young Drivers: Rates by State

Hawaii and Vermont offer cheap car insurance for 16-year-old drivers, while drivers 21 years of age get the lowest average rates in Nebraska and Ohio. Location plays a significant role in determining insurance rates for drivers of any age.

Car Insurance for Teens and Young Drivers: Rates by Provider

On average, drivers aged 21 pay $2,786 per year for full-coverage car insurance. That’s 60% less than the average rate of $6,912 paid by 16-year-old drivers. Of top providers on our list, Erie Insurance offers the most affordable rate for teen drivers, coming in at more than 50% below the market average.

What Affects Car Insurance Costs for New Drivers?

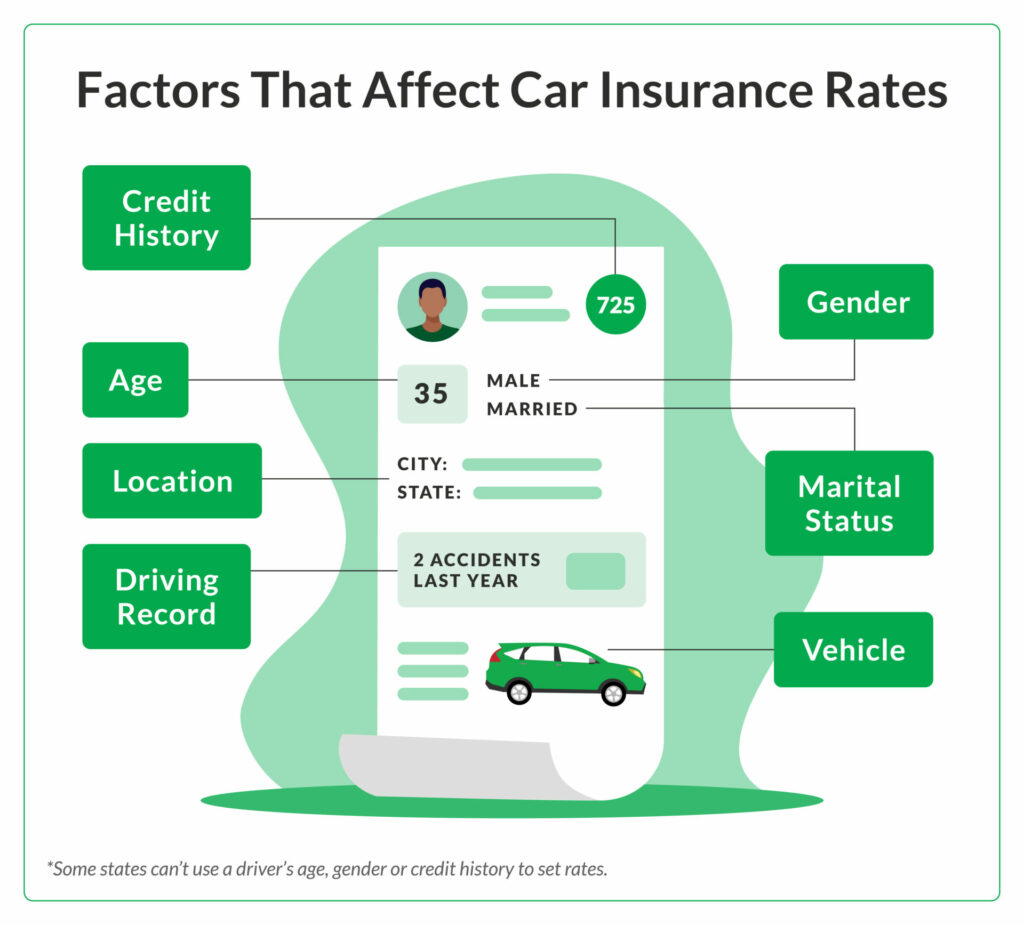

As we mentioned above, age and driving records impact the price of insurance, but insurers weigh other factors as well. Local insurance minimums impact the price, and so do traits like the recorded gender on the driver’s license in most states.

Car Insurance for Teenagers: FAQ

Below, you will find frequently asked questions about teenage car insurance.

Our Methodology

Because consumers rely on us to provide objective and accurate information, we created a comprehensive rating system to formulate our rankings of the best car insurance companies. We collected data on dozens of auto insurance providers to grade the companies on a wide range of ranking factors. The end result was an overall rating for each provider, with the insurers that scored the most points topping the list.

Here are the factors our ratings take into account:

- Cost: Auto insurance rate estimates generated by Quadrant Information Services and discount opportunities were both taken into consideration.

- Coverage: Companies that offer a variety of choices for insurance coverage are more likely to meet consumer needs.

- Reputation and experience: Our research team considered market share, ratings from industry experts and years in business when giving this score.

- Availability: Auto insurance companies with greater state availability and few eligibility requirements scored highest in this category.

- Customer experience: This score is based on volume of complaints reported by the NAIC and customer satisfaction ratings reported by J.D. Power. We also considered the responsiveness, friendliness and helpfulness of each insurance company’s customer service team based on our own shopper analysis.

Our credentials:

- 800 hours researched

- 45 companies reviewed

- 8,500+ consumers surveyed

*Data accurate at time of publication.