Our Thoughts on USAA Pet Insurance

USAA earned 4.3 out of 5 stars in our review based on our pet insurance methodology. Earning the title of our pick for USAA members and veterans, this provider partners with Embrace pet insurance to provide policies in all 50 U.S. states. With an Embrace plan through USAA, you can save up to 25% on a pet insurance policy for your dog or cat.

USAA pet insurance earned the maximum points possible in the plans, covered treatments, customer experience, waiting periods and eligible age limit rating categories of our methodology, with bonus points awarded for covering various treatments. However, it lost points for factors such as cost and reputation due to higher-than-average policy costs and low Trustpilot and Better Business Bureau (BBB) ratings.

While USAA pet insurance is worth considering thanks to its partnership with Embrace and policy discounts, this offering isn’t available to everyone. USAA only provides discounts and insurance to active military members, veterans and their families.

Pros and Cons

How USAA Pet Insurance Scored in Our Methodology

USAA pet insurance scored highly in our review, with an overall score of 4.3 out of 5 stars when rated and scored using our methodology. This makes its rating the 10th highest out of the 31 providers we’ve scored. It scored highest in our covered treatments rating category with bonus points for prescription meds, surgery and hospitalization, and spay and neutering coverage.

USAA Pet Insurance Plans and Pricing

USAA partners with Embrace pet insurance to provide accident and illness and accident-only plans for dogs and cats. Embrace also offers optional add-on coverages for exam fees, prescription drugs and a Wellness Rewards program for routine care services. USAA members can obtain a quote for an Embrace policy online or by phone, making it easy for pet owners to understand and purchase coverage the way they see fit, based on our experience.

How Much Does USAA Pet Insurance Cost?

The cost of a USAA pet insurance policy through Embrace will depend on your chosen coverage level, pet breed, age, health history and qualifying discounts as a USAA member. We’ve gathered quotes from Embrace using four pet profiles across all 50 U.S. states to better understand the average cost. Based on these profiles, the average cost of a pet insurance policy through Embrace is $73 for dogs and $39 for cats.

The cost of an Embrace policy is 11% more than the national average pet insurance cost for dogs and 22% more for cats, which is not ideal for pet owners looking for a budget-friendly plan. However, Embrace and USAA offer discounts for up to 25% off of a policy, which can help mitigate total costs.

As a USAA member, you automatically qualify for 15% off your total premium. You can also receive additional discounts for multiple pets or being former or current active-duty military. These discounts could make your total costs for an Embrace policy lower than the national average calculated by our team.

*We calculated the average cost for an accident and illness plan using the four pet profiles outlined in the cost section of our methodology. Costs are based on a plan with $10,000 in coverage, a $750 deductible and a 70% reimbursement rate.

Note that the accident-only plan has a flat-rate cost for dogs and cats over the age of 15. If your senior pet qualifies for this coverage, you’ll pay around $38 per month for a dog and $14 for a cat. We also used four sample pet profiles to calculate the average cost of Embrace’s Wellness Rewards add-on plan, which averages around $35 per month for dogs and cats.

What Does USAA Pet Insurance Cover?

USAA offers two different pet insurance plans in partnership with Embrace — an accident and illness plan and accident-only coverage. Embrace also offers exam fees, prescription drugs and wellness coverage add-ons with all plan types. We’ve highlighted available plan options in the following sections.

USAA Pet Insurance Accident and Illness Plan

USAA pet insurance through Embrace provides an accident and illness plan with customizable deductibles, annual limits and reimbursement rates. This plan, which is only available to pets aged 14 and under, covers vet bills related to:

- Cancer treatment

- Congenital conditions

- Dental trauma

- Genetic conditions

- Chronic conditions

- Prescription drug coverage

- Alternative therapies

- General, specialist and emergency care

- Diagnostic testing

- Physical therapy

- Hospitalization and surgery

- Lab tests and biopsies

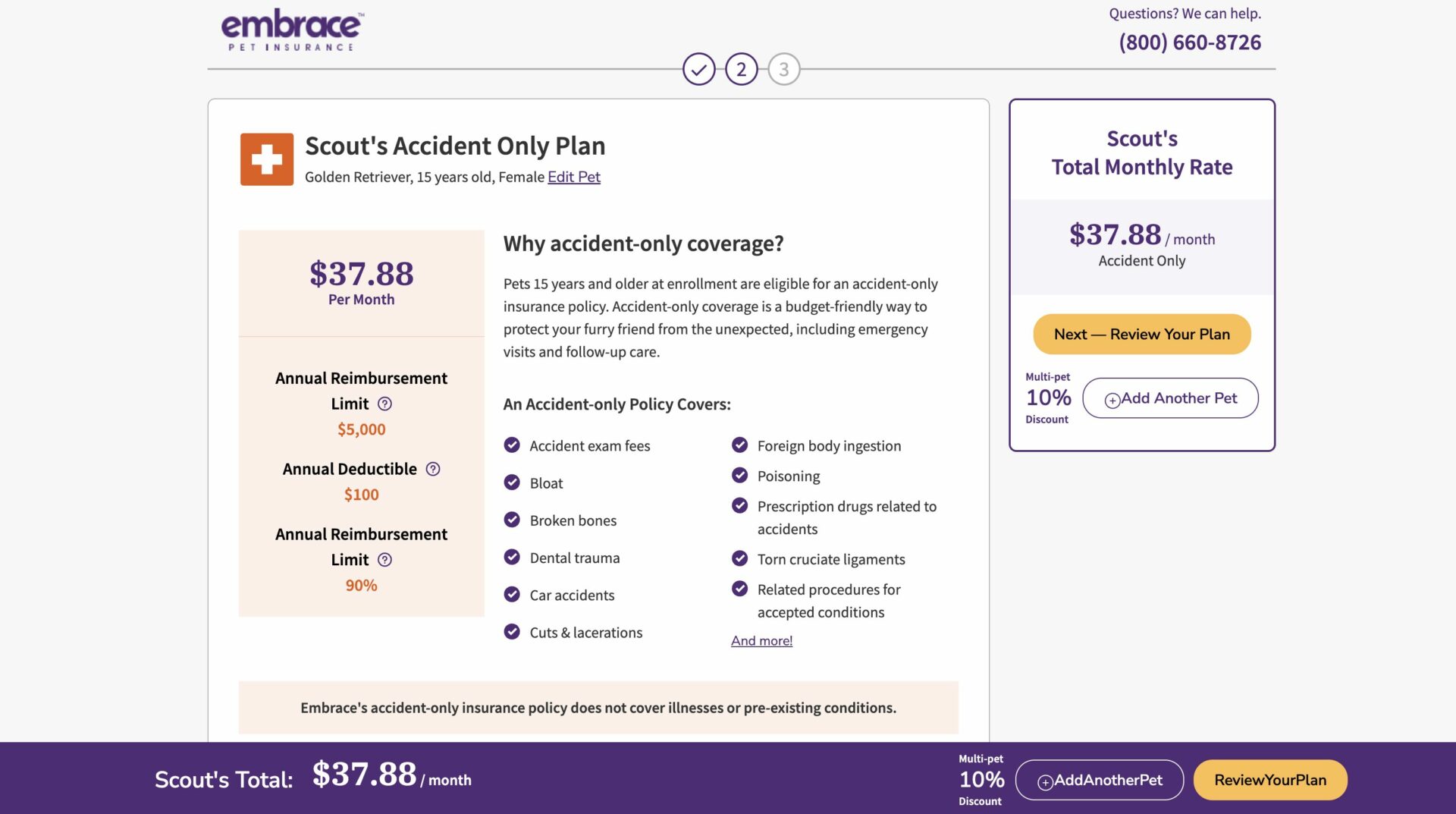

USAA Pet Insurance Accident-Only Plan

As indicated by its name, USAA pet insurance’s accident-only policy covers accidents, not illnesses and chronic conditions. Offered to pets aged 15 and older, it provides coverage for the following and more:

- Accident exam fees

- Bloat

- Broken bones

- Dental trauma

- Car accidents

- Cuts and lacerations

- Foreign body ingestion

- Poisoning

- Prescription drugs related to accidents

- Torn cruciate ligaments

USAA Pet Insurance Optional Add-On Coverage

Embrace pet insurance through USAA provides three different add-on coverages for extra protection and benefits — Wellness Rewards, exam fees and prescription drugs. Find details on each add-on in the following sections.

Wellness Rewards for Routine Care

The Wellness Rewards program through Embrace reimburses everyday costs associated with veterinary, training and grooming. The company bases costs for this plan on the amount of wellness rewards you choose per year, including:

- $250 in benefits: $19 per month

- $450 in benefits: $35 per month

- $650 in benefits: $52 per month

When calculating yearly costs associated with wellness benefits, our team determined that policyholders may only save $25 after paying average annual premiums. However, since the full benefit is available for immediate use, you could use the stipend similar to an interest-free loan you pay off over time.

Exam Fee and Prescription Drug Coverage

Exam fee coverage extends to veterinary bills for accidents and illnesses. Prescription drug coverage reimburses pet owners for vet-prescribed medications used to manage or treat a condition covered by an Embrace policy. This includes the following:

- Oral chemotherapy

- Allergy medication

- Insulin and supplies

- Anxiety medication

- Eye and ear drops

- Pain relievers

- Antibiotics

- Steroids

Customizable Coverage Levels

USAA provides two main plans for pet owners through Embrace, which we’ve detailed in the sections above. While the accident-only plan has set a deductible, annual limit and reimbursement rate, the accident and illness plan allows you to customize all three options.

Note that if you choose a higher annual deductible, lower annual limit and lower reimbursement rate, you should pay less each month. However, a lower monthly cost likely means you may pay more out of pocket when you file a claim.

We’ll break down how deductibles, coverage limits and reimbursement rates factor into your policy and the options USAA offers for each below.

Deductible Options

An insurance deductible is an amount you have to pay out-of-pocket before your coverage kicks in. So if you have a $100 deductible, your insurance provider won’t start covering claims until after you’ve paid $100 in veterinary expenses.

USAA offers the following deductible options for its accident-illness plans: $100, $250, $500, $750 or $1,000. If you’ve opted for an accident-only plan for your senior pup, you’ll have an annual deductible of $100.

Reimbursement Rates

Once you file a claim to cover your pet’s vet bills, your reimbursement rate determines what percentage of covered costs you get back. USAA’s reimbursement options for its accident-illness plans are as follows: 70%, 80% or 90%. You’ll have a reimbursement rate of 90% with an accident-only plan.

Annual Limit Options

A coverage limit is the maximum amount of money an insurance provider will pay out each year. For USAA pet insurance, you can choose from the following limits for an accident-illness plan: $5,000, $8,000, $10,000, $15,000 or unlimited. Accident-only plans include an annual limit of $5,000.

Sign-Up, Claims Filing and Payout Processes

You can sign up for a pet insurance policy with USAA using Embrace’s online quote tool or by speaking with a customer service representative via phone. Note that only active USAA members can get a quote — our research team was directed to a login portal when attempting to get a pet insurance quote on USAA’s website. However, because USAA partners with Embrace, the online sign-up process is likely similar. You will likely see the same plan options as a non-member purchasing a policy. The only difference is the discount offered through USAA by Embrace.

Gathering an online quote from Embrace requires you to answer a few questions about yourself and your pet. You’ll need to provide your pet’s name, breed, sex, species and age, as well as your ZIP code and email address. From there, you’ll arrive at a customization screen that allows you to choose your annual coverage limit, deductible, reimbursement rate and add-on coverages.

If you’re buying a plan for a senior pup, you’re limited to an accident-only coverage plan that doesn’t allow customization. However, you can purchase the same add-ons offered with Embrace’s accident-illness plans.

If you need to file a claim with your USAA pet insurance policy, you can do so through Embrace’s web portal, mobile app, email, fax or physical mail. If you submit your claim through the Embrace website or mobile app, you will only need to submit an itemized invoice from your vet and not a claim form.

Once your claim is submitted, you should receive an email from Embrace letting you know the company received it. Embrace should post updates in your account online or through the mobile app, stating on its website it processes claims within 10 to 15 business days. Claims are either paid by check or direct deposit. Note that USAA pet insurance doesn’t offer vet-direct pay.

Customers filing claims for the first time, such as this reviewer on Trustpilot, note how impressed they were with the entire claims process, stating they would recommend Embrace to other pet owners. Other reviewers say that Embrace provided clear explanations on coverage when their claim was reviewed, with refunds issued in a reasonable amount of time.

While most reviews we found around the claims process were positive, some customers, such as this one, were dissatisfied with the time it took to process their claims. We reached out to USAA for comment on its claims process but did not receive a response.

USAA Pet Insurance Waiting Periods and Age Restrictions

Waiting periods are used to help fight insurance fraud by preventing pet owners from filing claims on pre-existing conditions or prior accidents or illnesses. Like most pet insurance providers, USAA pet insurance policies through Embrace require you to wait a certain time before you can use your coverage.

Once you purchase your USAA pet insurance plan, you must wait 14 days before filing a claim for illnesses and 48 hours for accidents. The waiting period for orthopedic conditions is six months. However, Embrace allows you to waive the waiting period for orthopedic conditions with a veterinary examination.

Embrace has no restrictions on age for policy enrollment — cats and dogs of all ages are eligible for coverage. However, there are age restrictions around which policy a pet owner can buy. If your pet is 14 years old or younger, you can purchase an accident and illness policy with a customizable deductible, annual limit and reimbursement rate options. If your pet is 15 years or older, you can only purchase an accident-only plan without customization.

What Customers Think About USAA Pet Insurance

Since Embrace administers USAA pet insurance plans, we examined ratings for Embrace on platforms such as the Better Business Bureau (BBB) and Trustpilot to get a sense of customer satisfaction. At the time of writing, Embrace held a 3.2 out of 5-star rating with the BBB and a 4.2 out of 5-star rating with Trustpilot.

We read through Embrace’s most recent customer reviews to learn what customers appreciate and dislike about the company.

What Customers Like

- Easy claims process: Many policyholders noted how easy it was to file a claim with Embrace, with this customer specifically praising the company’s direct deposit feature and quick reimbursement time.

- Personable customer service representatives: Several reviewers noted how professional, kind and helpful Embrace’s customer service representatives are.

- Easy-to-understand policy terms: Many customers, such as this one, praised Embrace’s simple policy terms that made it easy to understand coverage.

What Customers Don’t Like

- Long claims processing times: Some policyholders lamented the time it took for their claim to process, with this policyholder stating their claim took 40 days to settle.

- Yearly rate increases: Many reviewers, such as this one, weren’t happy with their monthly premiums being raised exponentially, with no explanation from Embrace.

- Denial of valid claims: Some reviewers, such as this customer, felt Embrace should have covered their denied claim under the company’s policy terms.

Our team tried contacting USAA for comment on its negative reviews but did not hear back from the company.

USAA Pet Insurance vs. the Market

Learn more about the coverage, costs and more offered by USAA pet insurance, administered by Embrace, in comparison to other leading pet insurance providers.